Biweekly pay tax calculator

A 1000 bonus will generate an extra 616. Your Yearly Tax Savings.

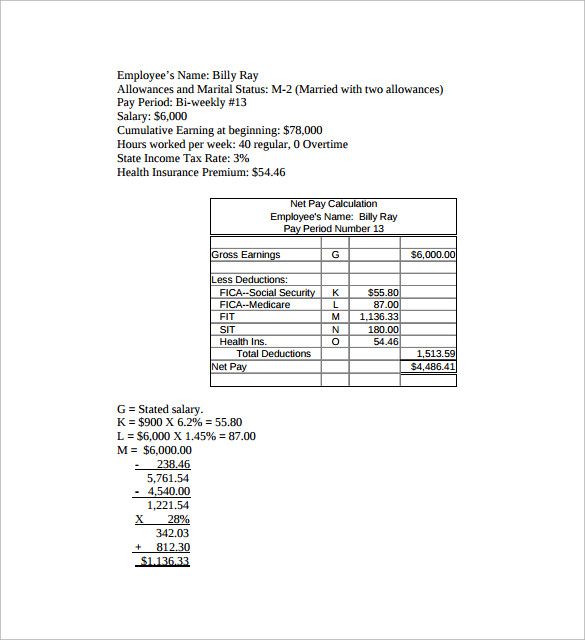

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Your average tax rate is 217 and your marginal tax rate is 360.

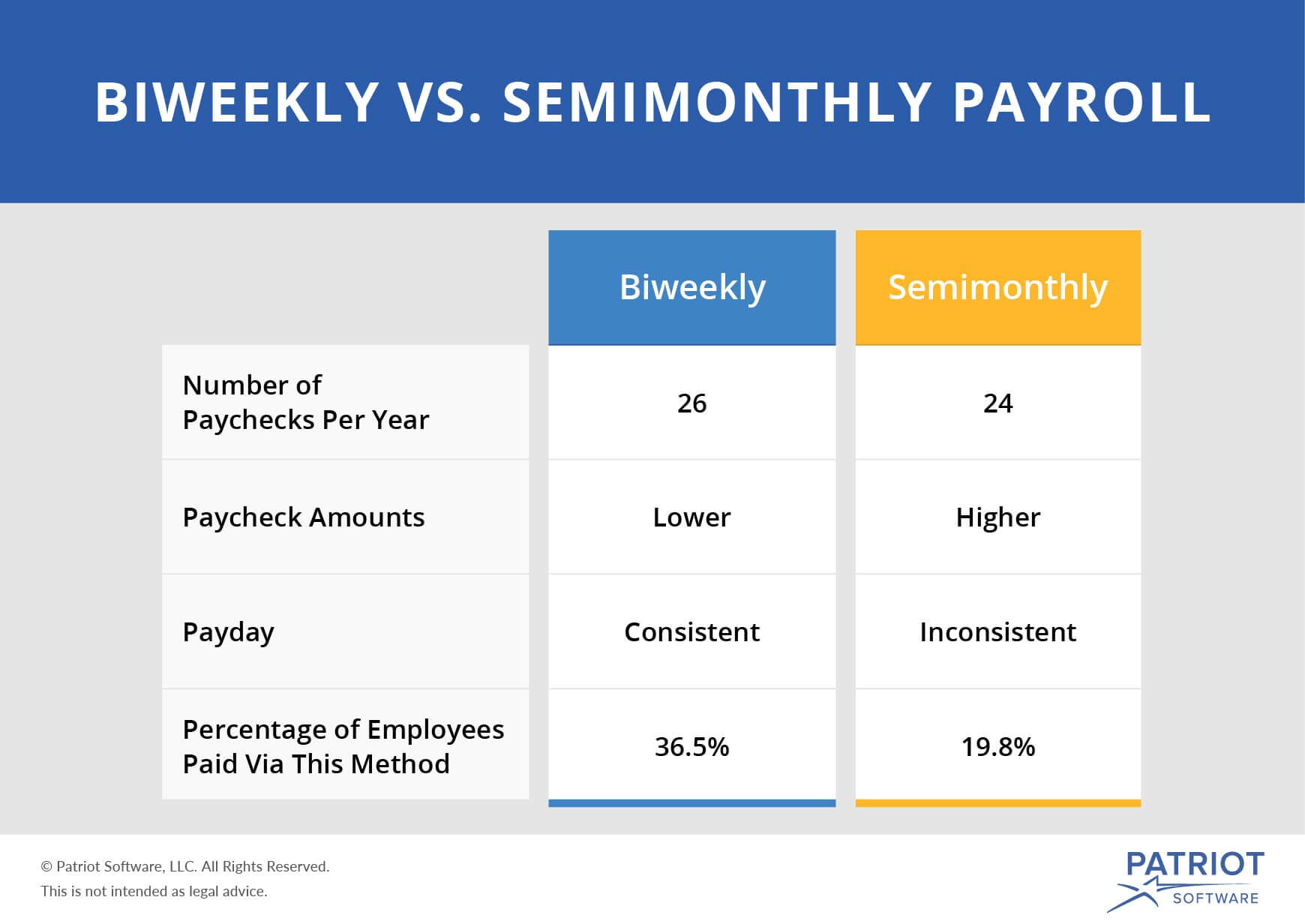

. There are 26 biweekly pay periods in a year whereas there are 24 semimonthly pay periods in a year. Thats 26 half payments a year or the equivalent of 13 full payments a year. You dont necessarily have to pay every other week to get the savings.

California government employees who withhold federal income tax from wages will see these changes reflected in 2021 payroll. This income tax calculator can help estimate your average income tax rate and your take home pay. How many income tax brackets are there in Malaysia.

Many employers give employees 2 weeks off between the year end holidays and a week of vacation during the summer reducing the work year to 25 biweekly pay periods. The charts below show the potential tax savings that you could miss out on by waiting. Sweden Tax Brackets and Other Information.

Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. Each year has 52 weeks in it which is equivalent to 26 biweekly periods. The income tax system in Sweden has 2 different tax brackets for residents.

Some people also use tax refunds. For instance an increase of 100 in your salary will be taxed 3843 hence your net pay will only increase by 6157. The biweekly loan calculator has a biweekly amortization schedule excel that breaks down all the payment details.

They should also consider contributing to tax-advantaged accounts such as an IRA a Roth IRA or a 401k. A 1000 bonus will generate an extra. For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399.

Please ensure that the information used in the calculation is. Another strategy for paying off the mortgage earlier involves biweekly payments. One option to consider is a biweekly every two week payment plan.

Based on the Withholding Limitations Worksheet PDF the Income Withholding Calculator is an interactive form designed to calculate withholding in accordance with federal and New York State law and regulationsThe calculator is meant as an additional tool to help employers calculate child support withholding. If your effective tax rate is around 25 then that would be like subtracting 2 from the 8 so youd take the hourly earnings add a zero behind it then. Biweekly vs Monthly Loan Calculator.

Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. So take the hourly wage add a zero behind it and then multiply that number by 8 to get your pre-tax biweekly income. When you have a mortgage at some point you may decide to try and pay it off early.

The Paycheck Calculator below allows employees to see how these changes affect pay and withholding. It can be a good option for those wanting to contribute more money toward a. Malaysia Income Tax Brackets and Other Information.

Self-employed people pay self-employment taxes which had them paying both halves of the tax. This marginal tax rate means that your immediate additional income will be taxed at this rate. Use the IRS Tax Withholding Estimator to make sure you have the right amount of tax withheld from your paycheck.

With biweekly mortgage payments you make 26 half-payments a year which equates to 13 total payments in a year. The other major advantage of a 401k plan is the tax savings from pre-tax contributions. For instance an increase of 100 in your salary will be taxed 3009 hence your net pay will only increase by 6991.

This income tax calculator can help estimate your average income tax rate and your take home pay. A biweekly pay cycle means that your employees are paid every two weeks always on the same day. For instance an increase of 100 in your salary will be taxed 3380 hence your net pay will only increase by 6620.

For 2020 the FICA limit is on the first 137700 of income. You can just divide your mortgage payment by 12 and add 112th the amount to your payment each month. How many income tax brackets are there in Sweden.

Both hourly and salaried employees may receive biweekly. Use our free 2022 Ontario income tax calculator to see how much you will pay in taxes. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a.

Weekly pay results in 52 pay periods per year and is commonly used by employers who have hourly workers. Depending on the calendar year there are sometimes 27 pay periods which can increase payroll costs. For more details check out our detail section.

The traditional period for amortization of a mortgage the time to pay it off is 25 years. To convert into a biweekly period this number would then be doubled. Employees receive 26 paychecks per year with a biweekly pay schedule.

Your Take Home Pay Only Changes By. But this is done in periods of five years at a time though it is possible to pay the mortgage down in a shorter period just not longer. The income tax system in Malaysia has 12 different tax brackets for residents.

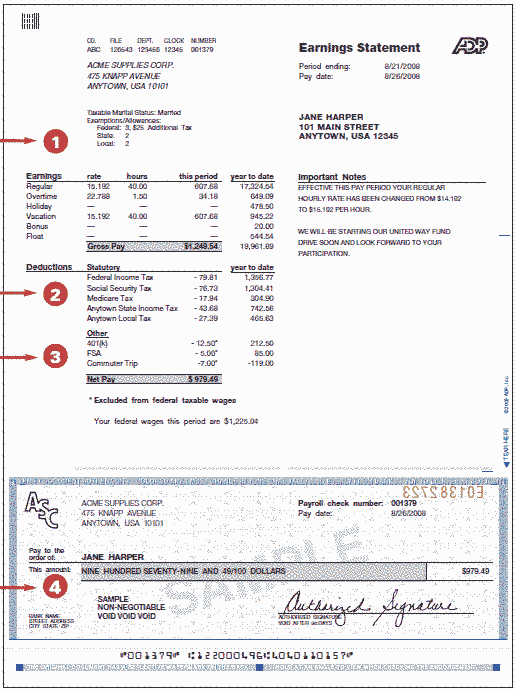

Using our retirement calculator. Employees and employers typically pay half of the 124 Social Security 145 Medicare benefit each for a total of 153. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator.

How does biweekly pay work. Fields notated with are required. You can also explore Canadian federal tax brackets provincial tax brackets and Canadas federal and provincial tax rates.

Luckily our quarterly tax calculator takes the guesswork out of a complicated task. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. For more details check out our detail section.

Therefore if your regular payment is 1500 a month you would pay 1625 each month instead. The employment income tax. The longer the amortization period the smaller the monthly payments will be but the more the loan will cost in total.

For example if the results from this calculator tell you to pay 1200 quarterly have your employer increase your withholding by 200 on your biweekly payroll. A 1000 bonus will generate an. If you pay biweekly youll make half of your monthly principal and interest payment every two weeks instead.

If you work 8 hours a day 5 days a week 50 weeks per year that comes out to 2000 hours per year. This results in the same amount of money being set aside without you having to do anything. Total Tax Insurance PMI Fees.

Tips For Parents Earning A Minimum Wage Salary Going Back To School Canadian Budget Binder

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Calculate Payroll Taxes Methods Examples More

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Calculation Of Federal Employment Taxes Payroll Services

If You Make 130 000 Year In Nyc What Is Your Take Home Bi Weekly Payment Quora

Paycheck Calculator Take Home Pay Calculator

The Pros And Cons Biweekly Vs Semimonthly Payroll

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Income Tax

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

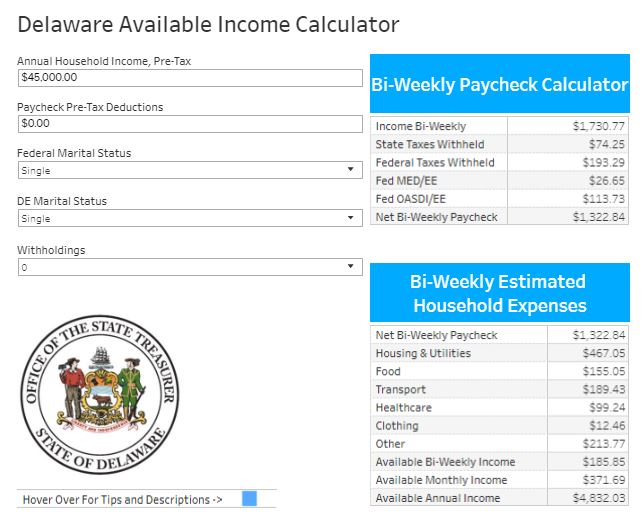

Delaware Available Income Calculator State Treasurer Colleen C Davis State Of Delaware