47+ how to get a mortgage if you are self employed

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Lowest Rates Easy Online Process.

How To Get A Mortgage If You Re Self Employed

A great credit score Credit score is a major factor in landing a mortgage no.

. Weve written a guide to first home deposits that youll find useful. Lenders will not want you to have too much debt. Two years of personal.

This is how your debt-to-income ratio DTI is. There used to be a huge gap between the ways that self-employed and employed borrowers got approved for. Your credit score is a crucial factor in determining whether.

At least two years of personal tax. Web selfemployment mortgage selfemployed homeloan scorp llc partnership shorts guitar 70srock View the full video here at. Web 2 hours agoMarch 4 2023 324 PM 2 min read.

Comparisons Trusted by 55000000. Employment verification A copy of your. Best Mortgage Lenders in Kansas.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. You own 25 or more of a business At least 25 of your income is from self-employment You receive. Fast Approval Low APR Rates No Hidden Fees Reliable Reviews Online Comparison.

Compare Rates Get Your Quote Online Now. Best Mortgage Lenders in Kansas. Ad Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offer.

Ad 5 Best Home Loan Lenders Compared Reviewed. Comparisons Trusted by 55000000. Consider providing documents like previous tax returns profit and.

Americans who became self-employed or started a business in 2022 should hire an accountant to do their tax returns to. Tax calculations and tax year overview SA302 These show your earnings. Web If you are looking to apply for a self-employed mortgage its a good idea to start preparing as early as possible.

Compare Rates Get Your Quote Online Now. Web If youre self-employed include your total business expenses as well as your personal living expenses. Web You may not plan to use your self-employment income to qualify for a mortgage but if you own 25 or more of that business you must still provide all the business information.

Mortgage lenders will want to know you can. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. If you are self-employed and plan to apply for a mortgage loan the following documentation will help you qualify.

Web Ideally you should aim to save up at least six months worth of income. Take the First Step Towards Your Dream Home See If You Qualify. And as lenders regard low-doc loans as.

Ad Updated FHA Loan Requirements for 2023. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Americas 1 Online Lender.

Web If the loan you want is for a first home there are now opportunities to get a home loan with a deposit as low as 5. Ad Americas 1 Online Lender. Web Workin overtime.

Web Youll need to provide the following documents if youre applying for a mortgage while self-employed. Web How to Get a Mortgage When Youre Self-Employed. Web When it comes to getting a mortgage while self-employed underwriters look at your existing debts instead of your income.

Web When applying for a mortgage expect lenders to request and review the following employment and income documents. Web As a guide Bendigo Banks low-doc home loan comes with a rate of 558 compared with 399 for its basic home loan. Web Borrower Be Prepared.

Web The mortgage industry has changed a lot over the last few years. Web In most cases self-employed mortgage loan borrowers need to provide the following documents to prove their income to a mortgage lender. Lowest Rates Easy Online Process.

Web Firstly if you have only been self-employed for a year and do not have several years of accounts then some of the high-street mortgage lenders may be off-limits. Web A lender will love to see documentation that demonstrates your ability to obtain a mortgage. Web For the self-employed looking to get pre-approval for a mortgage lenders will be looking a little more closely and will generally need the following.

SVP of Mortgage Lending. Web Consider the following to increase your chance of being approved for a mortgage while self-employed. Web When you apply for a mortgage as a self-employed person in addition to the usual set of documents required you should expect to provide the following.

Check Your Official Eligibility Today. Web Mortgage lenders may consider you to be self-employed if. Most people take out a mortgage to land a home according to the Consumer Financial.

Improve your credit score. Ad 5 Best Home Loan Lenders Compared Reviewed.

Self Employed Mortgages Guide Moneysupermarket

Self Employed Mortgages Guide Moneysupermarket

Self Employed Mortgages Guide Moneysupermarket

How To Get A Mortgage When You Are Self Employed

How To Get A Mortgage If You Re Self Employed Youtube

How To Get A Mortgage If You Re Self Employed

Maintaining Mission Meeting The Legal Requirement For B Corp Certifi

How To Get A Mortgage If You Re Newly Self Employed

How To Get A Mortgage If You Re Self Employed

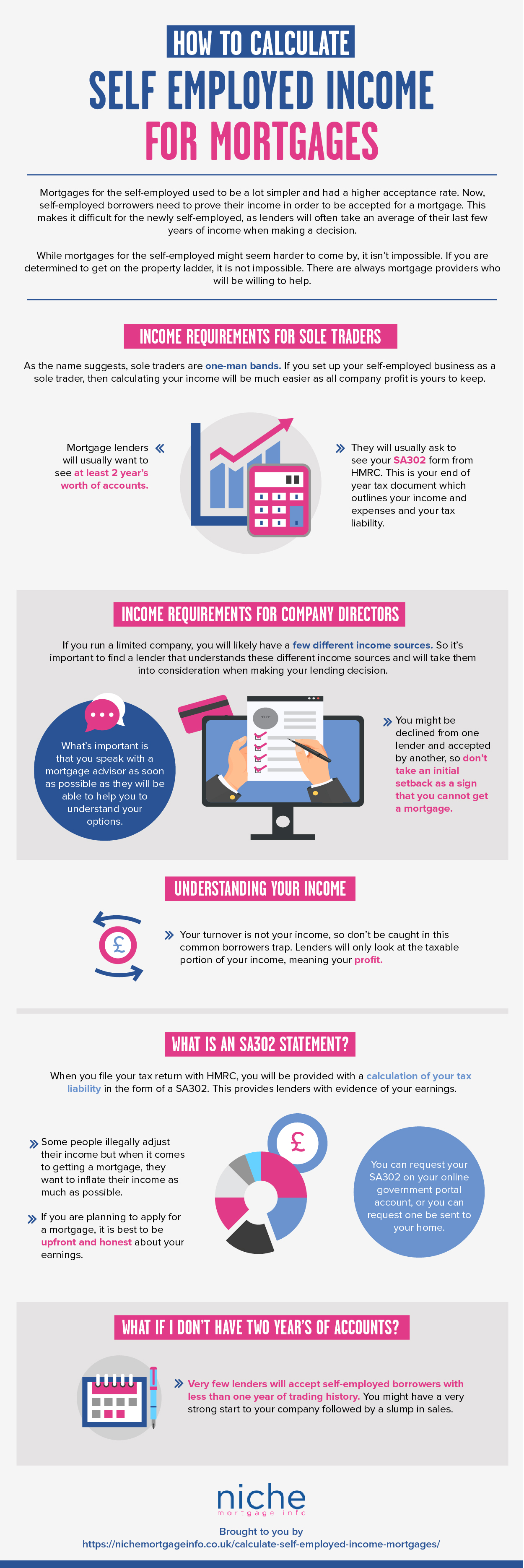

Mortgage Lenders Income Requirements For The Self Employed Niche

Self Employed

How To Get A Mortgage If You Re Self Employed The European Financial Review

How To Get A Mortgage When You Re Self Employed

How To Get A Mortgage When You Re Self Employed Superscript

Self Employed Mortgage Options Calculating Self Employed Income

Self Employed Mortgage Loan Requirements 2023

Self Employed Mortgages Guide Moneysupermarket